Calculating 401k contribution from paycheck

That means individuals under the age of 50 can invest up to 20500 in 2022 plus an additional 6000 through. A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur.

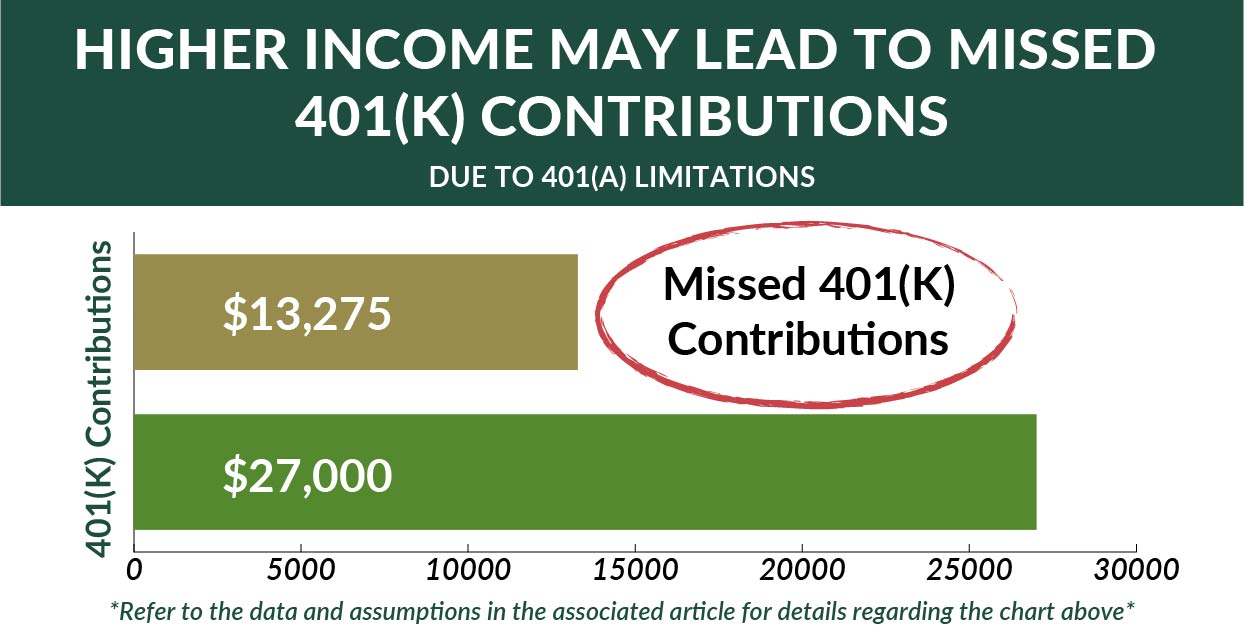

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits.

. For 2021 and 2022 you can contribute up to 6000 to a Roth or traditional IRA. This article will discuss how much you can contribute to your self-employed 401k plan. We assume you will live to 95.

We stop the analysis there regardless of your spouses age. Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax. How much you need to contribute each month to maximize employer contribution for monthly retirement withdrawal goal.

For the following plans the table is organized by tax year compensation deferralcontribution limits the catch-up limit and the overall contribution limit. Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals. 6 to 30 characters long.

If you are interested in your health especially what type of frame you have you can quickly find out your bodys frame size. Yes the contribution limits for 401k plans are separate from the limit for IRAs. In our example contributing to a pretax 401k saves 2250 per biweekly paycheck or 585 a year allowing more money to be invested without decreasing overall take home pay.

2023 SEP-IRA Contribution Limits. Lets be honest - sometimes the best salary calculator is the one that is easy to use and doesnt require us to even know what the salary formula is in the first place. You dont have to worry about calculating the precise dollar or percentage amount to perfectly nail that 401K maximum on your last paycheck of the year or promptly cut off 401K contributions if you max out sooner.

The deferralcontributions limits are the total amount an employee can defer or contribute to a retirement plan. Knowing your body frame is useful when considering what types of physical activities are suitable for you to participate in. You only pay taxes on contributions and earnings when the money is withdrawn.

Tax On A 401k Withdrawal After 65 Varies. Plus many employers provide matching contributions. The contributions go into a 401k account with the employee often choosing the investments based on options provided under the plan.

How you can forecast for your contributions affect on your retirement savings can be done through our online 401-K calculator. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Calculating payroll deductions is the process of converting gross pay to net pay.

2023 Traditional and Roth IRA Contribution Limits. Add a Free Salary Calculator Widget to Your Site. For 2021 the IRS says you can contribute up to 61000 in your self-employed 401k plan.

Must contain at least 4 different symbols. We automatically distribute your savings optimally among different retirement accounts. Employee 401k contributions for plan year 2022 will rise by 1000 to 20500 with an additional 6500 catch-up contribution allowed for those turning age 50 or older.

An employer may offer a matching contribution for either a Roth or a traditional 401k. The most you can contribute to a 401k in 2021 is 19500 or 26000. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. After two years of staying put at 6000 IRA contribution limits and catch-up contributions will increase in 2023 to 6500 7500 if 50. But the 401k also has an employee deferral which is 19500 if under age 50 and 26000 if 50 or over.

The Paycheck Hit. Simply enter your information in the following fields. On your Form 1040.

Compensation is the maximum limit for calculating contributions. Free calculators for your every need. Your tax bill will rise or your refund will shrink relative to.

Withholding Formula New York Effective 2022. You can make a contribution up to 25 of the W2 amount. A self-employed 401k plan is also know as a Solo 401k plan.

But if you want to know the exact formula for calculating salary then please check out the Formula box above. If you have both a Roth 401k plan and a Roth IRA your total annual contribution for all accounts in 2022 has a combined limit of 26500 20500 Roth 401k contribution 6000 Roth IRA. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes flexible spending account - health care and dependent care deductions from the amount computed in step 1.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. What Are the Benefits of a 401k. Enter your current IRA balance.

Your 401k plan account might be your best tool for creating a secure retirement. Assumes 1250 biweekly salary 125 biweekly contribution and 18 combined state and federal tax rate. How To Calculate Required Minimum Distribution For An Ira.

Learning how to calculate the square footage of a room is as simple as entering in the length of the room and the width of the room and pressing the calculate button. The ultimate goal is to. Not all employers do but some will match up to 3 or more of the.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. ASCII characters only characters found on a standard US keyboard. The main benefit to the solo 401k is that it allows larger contributions.

The returned excess contribution will be added to your total taxable wages for the previous year so an amended W-2 will be issued. Use our free online Frame Size Calculator to perform your calculations in the wink of an eye. SEP-IRA contribution limits will increase to 66000 per year for 2023 up from 61000 per year in 2022.

The 401k normally has a profit sharing component that acts just like a SEP. If youre 50 or older the limit is 7000. Can I have company A treat my 2017 401K contribution like an over-contribution.

401k Plan is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after-tax depending on the options offered in the plan. The formula to calculate square footage is simply length times width. The Square Footage Calculator is a super tool for calculating the square footage of a room.

In any qualified. We assume that the contribution limits for your retirement accounts increase with inflation.

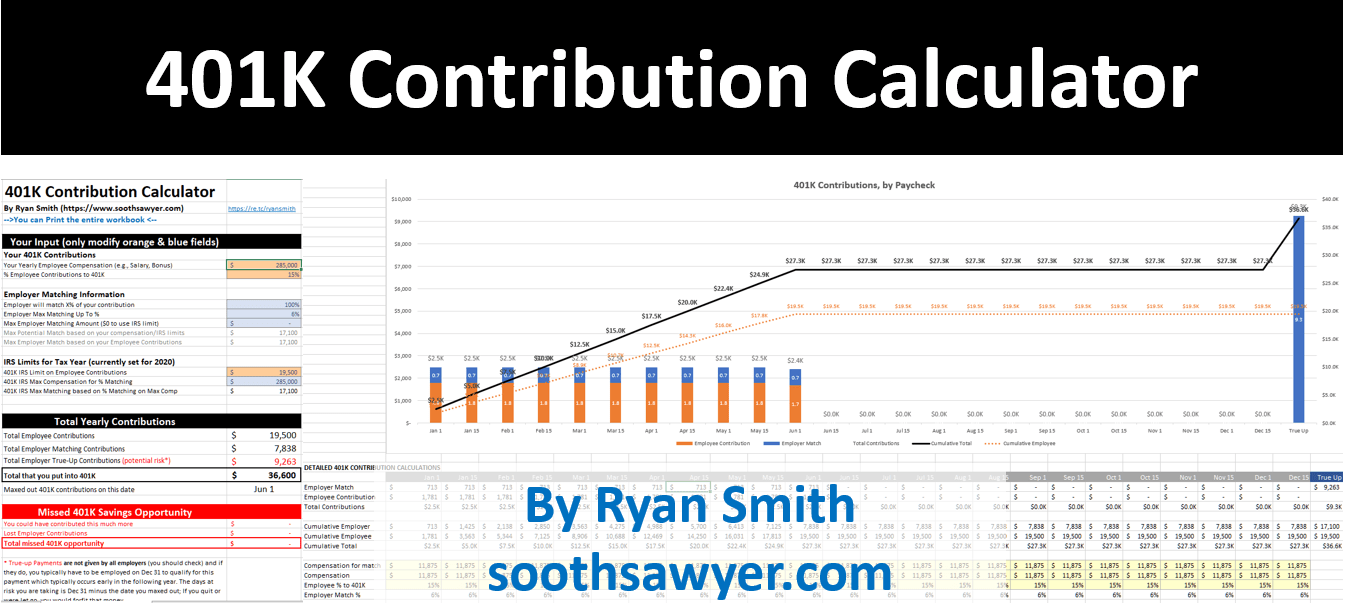

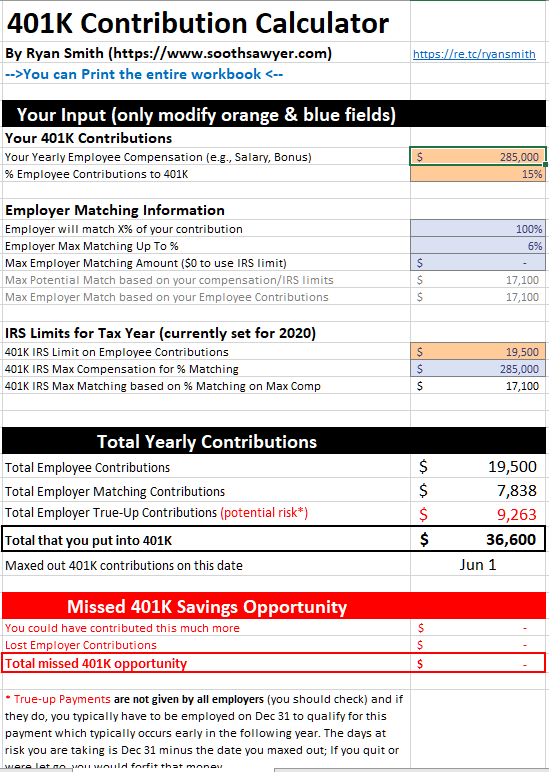

401k Employee Contribution Calculator Soothsawyer

Solo 401k Contribution Limits And Types

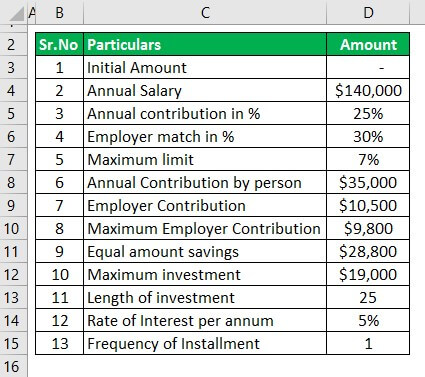

401k Contribution Calculator Step By Step Guide With Examples

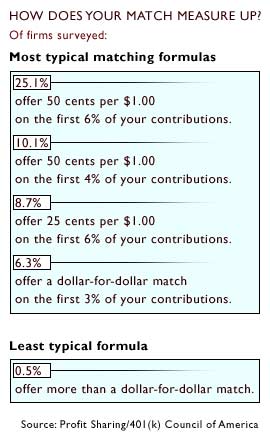

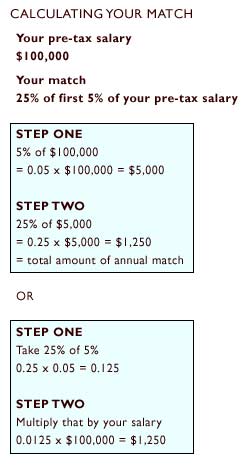

Doing The Math On Your 401 K Match Sep 29 2000

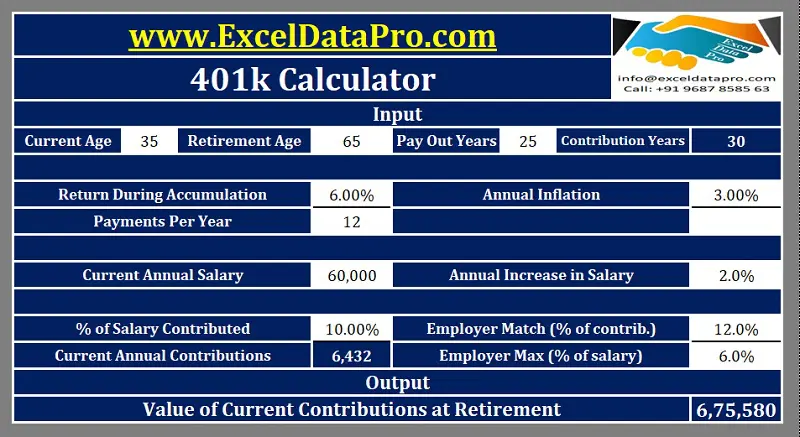

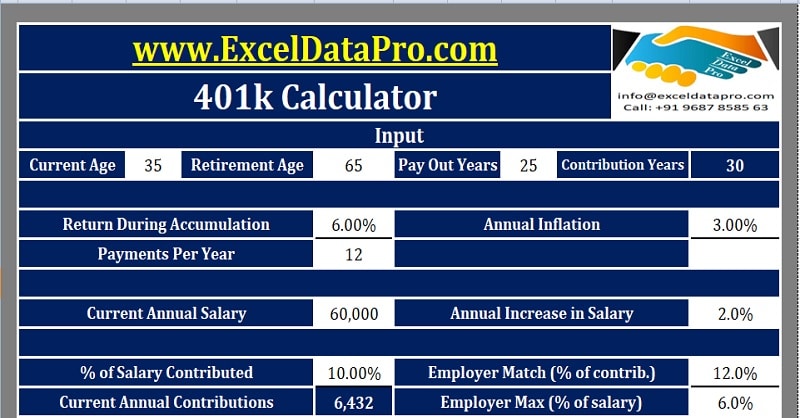

Download 401k Calculator Excel Template Exceldatapro

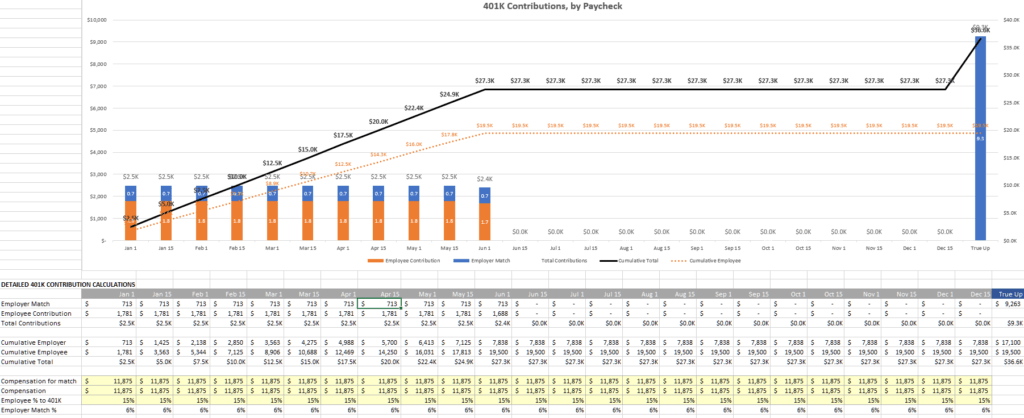

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

401k Employee Contribution Calculator Soothsawyer

401k Contribution Calculator Step By Step Guide With Examples

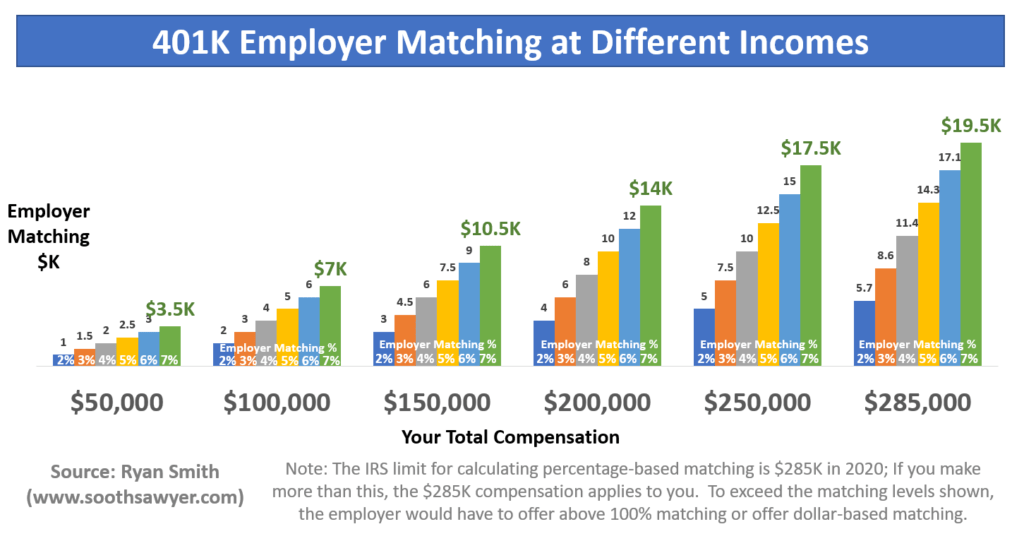

What Is A 401 K Match Onplane Financial Advisors

Download 401k Calculator Excel Template Exceldatapro

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Free 401k Calculator For Excel Calculate Your 401k Savings

Doing The Math On Your 401 K Match Sep 29 2000

The Maximum 401k Contribution Limit Financial Samurai

401k Employee Contribution Calculator Soothsawyer

How Much Can I Contribute To My Self Employed 401k Plan

401 K Plan What Is A 401 K And How Does It Work